39+ can i claim mortgage interest on taxes

If you give the owner money and the owner pays the property taxes the owner can take the deduction but. For mortgages taken out after December 14 2017 the interest on the first 750000 is.

Land Package For Barndominium Top 14 Things To Consider

Web If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and local taxes itemizing would have given them an extra 11300.

. Web You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your home. Web 1 Best answer. Your mortgage lender sends you.

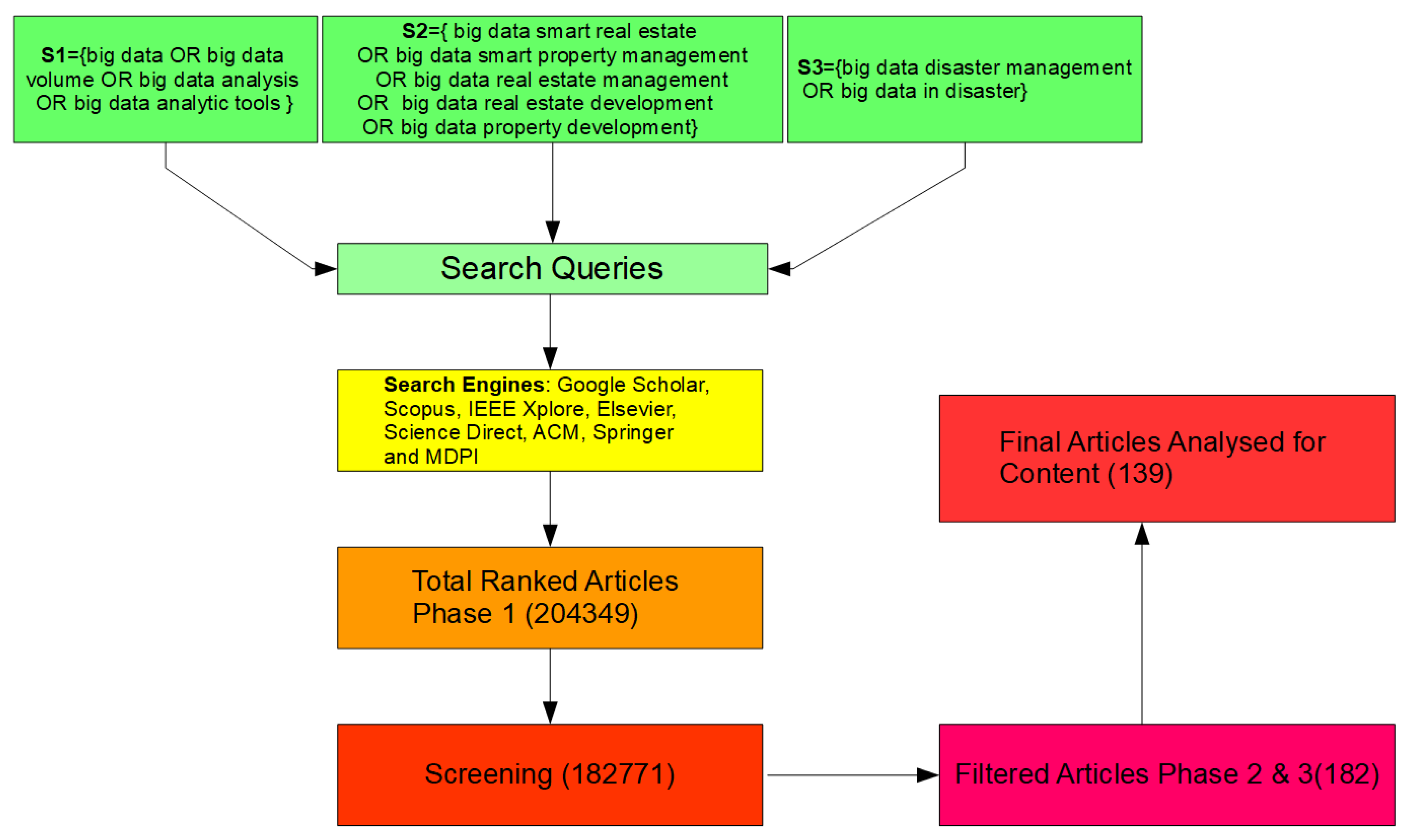

Amid the economic turmoil caused by the coronavirus. Web The IRS places several limits on the amount of interest that you can deduct each year. June 4 2019 557 PM.

See my updated answer below 2. Web However due to the Tax Cuts and Jobs Act the amount you can claim may be reduced. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

File your taxes stress-free online with TaxAct. Web If a lump sum amount was paid to reduce the interest rate on a mortgage only a pro-rated portion of that lump sum is deductible in the tax year it was paid. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

Ad Over 90 million taxes filed with TaxAct. Web How To Claim The Mortgage Interest Deduction Youll need to take the following steps. So if each person paid 50 of the mortgage each person is only eligible to.

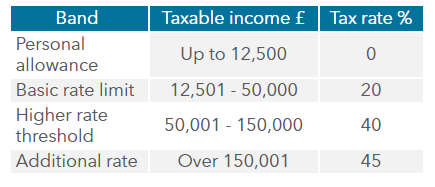

Web How much interest can I claim. Most homeowners can deduct all of their mortgage interest. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Filing your taxes just became easier. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows. Start basic federal filing for free.

Web 2 days agoWhen it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. If you are on the deed with someone else you should divide the. Web How much of a mortgage is tax deductible.

You can deduct mortgage interest paid on qualified home for loans up to 1 million or 500000 if married filing separately. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web The answer is that you can only claim the deduction for the interest you actually paid.

Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web How to Claim the Home Mortgage Interest Deduction.

File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Homeowners who bought houses before. Then yes you can enter the interest paid on the mortgage.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. For tax years before 2018 the interest paid on up to 1 million of acquisition. Look in your mailbox for Form 1098.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web Homeowners who requested forbearance on their mortgages last year could face tax implications this year. Web You can treat a home under construction as a qualified home for a period of up to 24 months but only if it becomes your qualified home at the time its ready for.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Barndominium Construction Loan Valuable Facts You Should Know

Mortgage Interest Tax Deduction 2022 What If You Forget

Mortgage Interest Deduction A Guide Rocket Mortgage

10 Mortgage Form Templates In Pdf Doc

Mortgage Interest Deduction And Your Tax Partner What If Your Partner Leaves

Indiaherald100114 By India Herald Issuu

39 W Dorsey Ln Hyde Park Ny 12538 Realtor Com

10 Mortgage Form Templates In Pdf Doc

4905 North Willow Road Ozark Mo 65721 60235712 Reecenichols Real Estate

Mortgage Interest Deduction A Guide Rocket Mortgage

Free 9 Owner Finance Contract Samples In Ms Word Google Docs Apple Pages Pdf

Mortgage Interest Deduction Bankrate

39 Sample Household Budgets In Pdf Ms Word

India Herald 082714 By India Herald Issuu

Mortgage Interest Deduction Save When Filing Your Taxes

Mortgage Interest Tax Relief Changes Explained Taxscouts

Uk Tax Archives The Evidence Based Investor